Welcome to your 2019 Benefits!

At CKE, quality and service are key ingredients in our recipe for success. But it’s not just our fresh and innovative menu that makes us Impossible to Ignore — it’s also our people. That’s why CKE proudly offers up a benefits package created with you in mind.

Medical/Prescription

Medical Insurance - Aetna

|

HSA Premier Plan

Lowest Premiums Annual Deductible $3,500 (I) Network Availability In-Network Only Primary Doctor's Visit Cost 30% after deductible Plan pays for Preventive prescriptions Out-of-Pocket Maximum $6,450 (I) |

Premier Plan

Low Deductible & Copays Annual Deductible $750 (I) Network Availability In-Network Only Primary Doctor's Visit Cost $20 copay Plan pays for Preventive prescriptions Out-of-Pocket Maximum $3,375 (I) |

HSA Flex Preferred Plan

Moderate Deductible Annual Deductible $1,750 (I/In-Network) Network Availability In and Out-of-Network Primary Doctor's Visit Cost 20% co-insurance Plan pays for Preventive prescriptions Out-of-Pocket Maximum $3,500 (I) |

Provider Search

Before you select a plan, please take the time to research that your providers are in-network. To find in-network providers, please visit the Aetna Provider Search below. If you aren't sure your search results are correct, please contact the Aetna Concierge to verify.

Dental

Dental - Cigna

Good dental health is a critical component of your overall health. Your dental plan is through Cigna and provides benefits for preventive, basic and major services. To find an Cigna network dentist in your area, visit the Cigna website.

|

Dental PPO

Deductible $50 (I) Annual Benefit Maximum $1,500 Orthodontia 50%; Lifetime Max $1,500 |

Dental HMO (California-Only)

No Deductible No Annual Deductible Orthodontia Cost based on schedule |

Vision

Vision - VSP

If you wear glasses or contacts, you know vision expenses can add up. At CKE, vision benefits are provided by VSP. Even if you don’t wear contacts or glasses, annual eye exams are recommended. All VSP Vision plans come with one of the largest vision networks in the country. To find a Vision provider, visit the VSP Vision website.

|

Vision Choice w/ Computer Care

$20 copay / 12 months Eye Exams $10 copay / 12 months Prescription Glasses Exam Up to $60 copay / 12 months Contact Lenses Exam $20 copay Diabetic Eyecare Plus $30 copay Computer Vision Exam |

Vision Choice Standard

$20 copay / 12 months Eye Exams $10 copay / 12 months Prescription Glasses Exam Up to $60 copay / 12 months Contact Lenses Exam $20 copay Diabetic Eyecare Plus |

Health Savings Account (HSA)

Health Savings Account (HSA)

|

Reasons to Elect an HSA

Your funds rollover from year-to-year. Contribute tax-free deposits from your paychecks into your account automatically! Lastly, you can pay for health care expenses, save for retirement, and more! NEW THIS YEAR! CKE will match your HSA contributions dollar-for-dollar up to $500. |

Pay for Health Care Expenses

Use your HSA as an option to pay for your health care expenses tax-free. A debit card is provided to you, making paying for your services easier than ever before. |

Annual IRS Contribution Limits

|

Individual Contribution

2019 HSA Annual Contribution Limit $3,500 |

Family Contribution

2019 HSA Annual Contribution Limit $7,000 |

Flexible Spending Accounts (FSA)

Flexible Spending Account (FSA)

Want to reduce your taxable income and increase your take-home pay? Enroll in an FSA and start saving money on eligible health care and/or dependent care expenses.

|

Health Care FSA

Contribute pre-tax dollars from your paycheck to pay for eligible health care expenses for you and your dependents. $2,700 Annual Contribution Limit |

Dependent Care Spending

A Dependent Care enables you to set aside pre-tax dollars to pay for qualified dependent care expenses. Funds can be used to pay for day care, preschool, elderly care or other dependent care. $5,000 Annual Contribution Limit |

Commuter Benefit

Pay for transit passes and parking expenses at or near work using pre-tax contributions. $260 Monthly Contribution Limit |

Life And Disability

Life and Disability

|

Company Provided (CKE-paid)

Basic Life and Accidental Death and Dismemberment (AD&D) CKE provides 1x/annual salary up to $250,000 for these benefits at no cost to you. As you complete the enrollment process, you will see your coverage amounts. Long-Term Disability If you are unable to work for an extended period of time due to a covered disability, this benefit will replace 40% of your monthly income up to $10,000 beginning at 6 months off of work. You may purchase an additional 20% as a voluntary add-on to make your benefit a total of 60%. Short-Term Disability (STD) Provides you with 60% of your weekly income up to $1,500 if you can’t work temporarily due to a covered illness, injury or a pregnancy-related condition. Benefits for employees in CA will coordinate with CA SDI benefits. Not available in NY, NJ, HI, RI. |

Voluntary (Employee-paid)

Voluntary Supplemental Life Insurance Helps provide financial protection in the event of your death, to help cover costs such as funeral expenses, daily expenses and college tuition. Elect up to 5x/annual salary up to $1,000,000. Dependent Life Insurance You may select coverage for your spouse in units of $10,000 to a maximum of $250,000, not to exceed 50% of your coverage amount. The cost of coverage will be based on your spouse’s age. Evidence OF Insurability (EOI) is required for a spouse that elects an amount over the GI amount, which is $20,000. Your Unmarried, Dependent Children You may select coverage for your unmarried, dependent children in units of $2,500 to a maximum of $10,000. The maximum benefit for children under six months is $2,500. Child coverage does not requires EOI. Voluntary Accidental Death & Dismemberment (AD&D) You may purchase additional Accidental Death & Dismemberment coverage for you and your dependents. Elect up to 10x/annual salary up to $1,000,000. |

Retirement (401k)

CKE Savings Plan

Take the steps toward a better future today.

Maintain your current lifestyle in retirement.

For each year of retirement, many experts suggest you’ll need at least 80% of your annual preretirement income to maintain your standard of living. And thanks to medical advancements, many people are living longer, which could mean a longer retirement and a need to save a larger amount of money.

Reduce your current tax bill and possibly boost your refund.

Every pretax dollar you contribute to the plan reduces your current taxable income, which means you could lower your overall income taxes. You may also be eligible for the Saver’s Credit, an income tax credit available to some people who contribute to an employer’s retirement plan or IRA.1

Pick from a variety of investment options.

The plan offers a wide variety of investment options so you can personalize your investment portfolio to meet your specific preferences and goals.

Save easily with payroll deductions.

Make it easy to pay yourself first.

Employer Matching Contributions

CKE will contribute $0.25 for every $1.00 that you contribute, up to 6% of your pay.

Try to save at least 6% to ensure you aren’t missing out on receiving the maximum matching contribution.

Take the steps toward a better future today.

Maintain your current lifestyle in retirement.

For each year of retirement, many experts suggest you’ll need at least 80% of your annual preretirement income to maintain your standard of living. And thanks to medical advancements, many people are living longer, which could mean a longer retirement and a need to save a larger amount of money.

Reduce your current tax bill and possibly boost your refund.

Every pretax dollar you contribute to the plan reduces your current taxable income, which means you could lower your overall income taxes. You may also be eligible for the Saver’s Credit, an income tax credit available to some people who contribute to an employer’s retirement plan or IRA.1

Pick from a variety of investment options.

The plan offers a wide variety of investment options so you can personalize your investment portfolio to meet your specific preferences and goals.

Save easily with payroll deductions.

Make it easy to pay yourself first.

Employer Matching Contributions

CKE will contribute $0.25 for every $1.00 that you contribute, up to 6% of your pay.

Try to save at least 6% to ensure you aren’t missing out on receiving the maximum matching contribution.

Work/Life Benefits

Work Life Benefits

|

Critical Illness

Up to $30,000 guaranteed issue. A cash benefit is payable to you at time of diagnosis of a covered critical illness and is paid regardless of any other coverage. |

Accident

Off-the-Job Protection. The High Plan includes $1,500 for Hospital Confinement, $75 for Outpatient Physician, and up to $300 for Emergency Room coverage. |

|

Auto/Legal/Home/Pet

Save money on the lifestyle benefits you need, with group discounts and convenient payroll deductions. |

Hospital Indemnity

This plan pays you benefits when you are confined to a hospital, whether for planned or unplanned reasons. |

Enroll NOW!

Enrollment Instructions

If you were recently hired or re-hired, you should receive a registration link to the email address on file.

If you were not hired recently or still have to create/register your Benefits account, follow the enrollment instructions provided below.

- If you have a CKE email address, the registration link will be sent to that email address.

- If you do not have a CKE email address, the registration link will be sent to your personal email address on file.

- Follow the instructions in the email to create/register your Benefits account.

If you were not hired recently or still have to create/register your Benefits account, follow the enrollment instructions provided below.

|

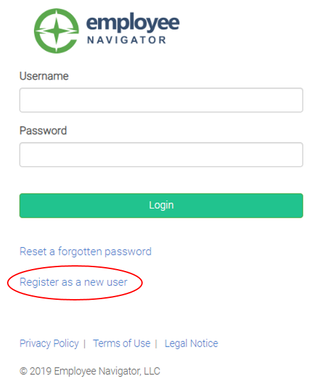

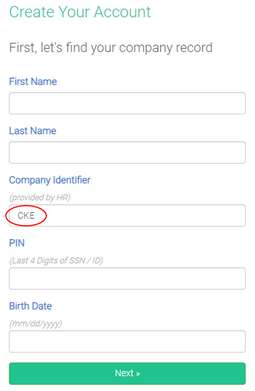

Step 1: Visit Employee Navigator Benefits Website Step 2: Click on "Register as a new user". Step 3: Enter your own Personal Information (Company Identifier will be "CKE") and click Next. Step 4: You will be prompted to create a username and password.

|

Don't Forget...

You must enroll in or decline benefits within 30 days of your hire date as a benefits-eligible employee. If you miss this deadline, you won’t have the opportunity to enroll again until Annual Open Enrollment. The only exception to this rule is if you have a “qualified life event” such as marriage, divorce, the birth of a child, or the loss of coverage under your spouse’s medical plan.

Adding dependents?

If you are adding new dependents to your plan, please have their dates of birth and Social Security Number available.

Did you call the concierge?

Did you call the Aetna Concierge to ensure you are selecting the best medical plan for your family?

Aetna Concierge

The Aetna Concierge has the answers to your questions about your benefits or healthcare services. They can help you decide what health plan to select by explaining plan details, finding a provider in your area, and more! They are available for you at 855-217-2836

Adding dependents?

If you are adding new dependents to your plan, please have their dates of birth and Social Security Number available.

Did you call the concierge?

Did you call the Aetna Concierge to ensure you are selecting the best medical plan for your family?

Aetna Concierge

The Aetna Concierge has the answers to your questions about your benefits or healthcare services. They can help you decide what health plan to select by explaining plan details, finding a provider in your area, and more! They are available for you at 855-217-2836

Making Changes

Making Changes - Qualified Life Events

If you experience one of the events below, you will have 30 days from the date of your event or change in coverage.

To make the appropriate changes to your benefits, follow the instructions below:

*for other events (Dependent's Gain/Loss of coverage), the date of the event is the first day your dependent no longer has their previous coverage

Please note that all life events will require formal documentation be submitted to the benefits department.

If you experience one of the events below, you will have 30 days from the date of your event or change in coverage.

- Marriage

- Birth/Adoption

- Death of a Covered Dependent

- Divorce

- Gain/Loss of Coverage for an Eligible Dependent (Spouse or Dependent Child)

To make the appropriate changes to your benefits, follow the instructions below:

- Visit Employee Navigator Benefits Website

- Log in with your username and your password (If you are a new user, click on the Enroll Now section above to create your account)

- Click the "Adjust Coverage" icon, select the appropriate life event, and enter the appropriate event date*

*for other events (Dependent's Gain/Loss of coverage), the date of the event is the first day your dependent no longer has their previous coverage

Please note that all life events will require formal documentation be submitted to the benefits department.

- Marriage - a copy of the marriage certificate

- Divorce – a copy of the final divorce decree with the file date and judge’s signature.

- Birth – a copy of the birth certificate or the mother’s copy received in the hospital.

- Adoption – a copy of final adoption papers signed by a judge or a document stating the child has been placed in anticipation of adoption from the adoption agency.

- Death – a copy of the death certificate.

- Dependent’s Gain/Los of Coverage Elsewhere – a copy of the hire/termination letter must be on company letterhead and state the hire/termination date and the date the employer-sponsored coverage either began or ended.

COBRA

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss, reduction in the hours worked, transition between jobs, death, divorce, and other life events. Qualified individuals may be required to pay the entire premium for coverage up to 102 percent of the cost to the plan.

COBRA generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage (called continuation coverage) in certain instances where coverage under the plan would otherwise end.

COBRA generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage (called continuation coverage) in certain instances where coverage under the plan would otherwise end.