Welcome to your 2024 Benefits!

Way to go! You’re now eligible for CKE benefits for 2024! Here’s why:

You have been designated as a full-time employee because you worked an average of 30 hours or more per week during your Initial Measurement Period. Under the Affordable Care Act (ACA), this qualifies you for Company Benefits, as detailed in the letter you should have received by mail.

Please take the time to understand your benefit enrollment options below.

When you are ready to enroll, click the Enroll Now! section below and follow all instructions!

Way to go! You’re now eligible for CKE benefits for 2024! Here’s why:

You have been designated as a full-time employee because you worked an average of 30 hours or more per week during your Initial Measurement Period. Under the Affordable Care Act (ACA), this qualifies you for Company Benefits, as detailed in the letter you should have received by mail.

Please take the time to understand your benefit enrollment options below.

When you are ready to enroll, click the Enroll Now! section below and follow all instructions!

Frequently Asked Questions

When do my benefits start?

You should have recently received a letter, explaining your eligibility for benefits, in accordance with the Affordable Care Act (ACA). The letter should have also specified a benefit start date and enrollment deadline.

When you enroll, these elections will be in place until the end of the Plan Year, December 31, 2024.

When you enroll, these elections will be in place until the end of the Plan Year, December 31, 2024.

How do I enroll?

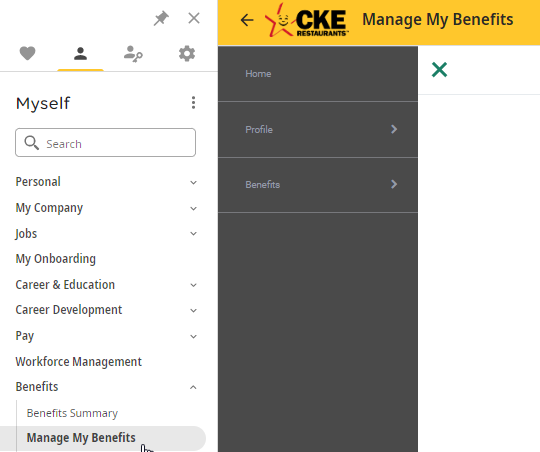

|

All Benefit Enrollment elections will be made in CKE's new MyStar system. To get started, log into your MyStar profile and select "Manage My Benefits". This link will take you directly to your Open Enrollment.

*** Important *** Please be sure to complete the entire enrollment. Your benefits enrollment is now like an online shopping experience, where you add various coverages to your shopping cart and are displayed with a total cost per paycheck. Once you have made your elections, please be sure to check out and obtain a copy of your enrollment confirmation statement. If you do not complete the entire enrollment process and check out, your benefit enrollments will not be saved and you will not have coverage in 2024. |

Who should complete enrollment?

We encourage all CKE employees to take the time to complete their available enrollment opportunities.

ACA Full-time Crew Members and Shift Leaders are eligible for CKE's Medical, Dental, Vision, HSA, and Voluntary Benefit Plans. This is a great opportunity to make sure that you are enrolled in the plans that best fit your and your family's needs.

ACA Full-time Crew Members and Shift Leaders are eligible for CKE's Medical, Dental, Vision, HSA, and Voluntary Benefit Plans. This is a great opportunity to make sure that you are enrolled in the plans that best fit your and your family's needs.

What happens if i don't enroll?

If you do not enroll, you will not have coverage in 2024.

Changes cannot be made throughout the year and your next opportunity to enroll will be during Open Enrollment for the 2024 Plan Year. The exception to this is if you experience a qualified Life Event (marriage, birth, adoption, etc.). For more details, visit the Making Changes section of the this website.

Changes cannot be made throughout the year and your next opportunity to enroll will be during Open Enrollment for the 2024 Plan Year. The exception to this is if you experience a qualified Life Event (marriage, birth, adoption, etc.). For more details, visit the Making Changes section of the this website.

When do my benefits start?

All benefits elected during your applicable enrollment period typically begin on January 1, 2024 and will continue through December 31, 2024.

You will see your new 2024 benefit premiums deducted from your weekly paycheck, beginning on January 12, 2024.

You will see your new 2024 benefit premiums deducted from your weekly paycheck, beginning on January 12, 2024.

Can I make changes to my benefits after enrollment?

You can only change your benefits in the middle of the Plan Year if you experience a qualified Life Event (marriage, birth, adoption, etc.). For more details, visit the Making Changes page of the this website.

2024 Benefit Plans

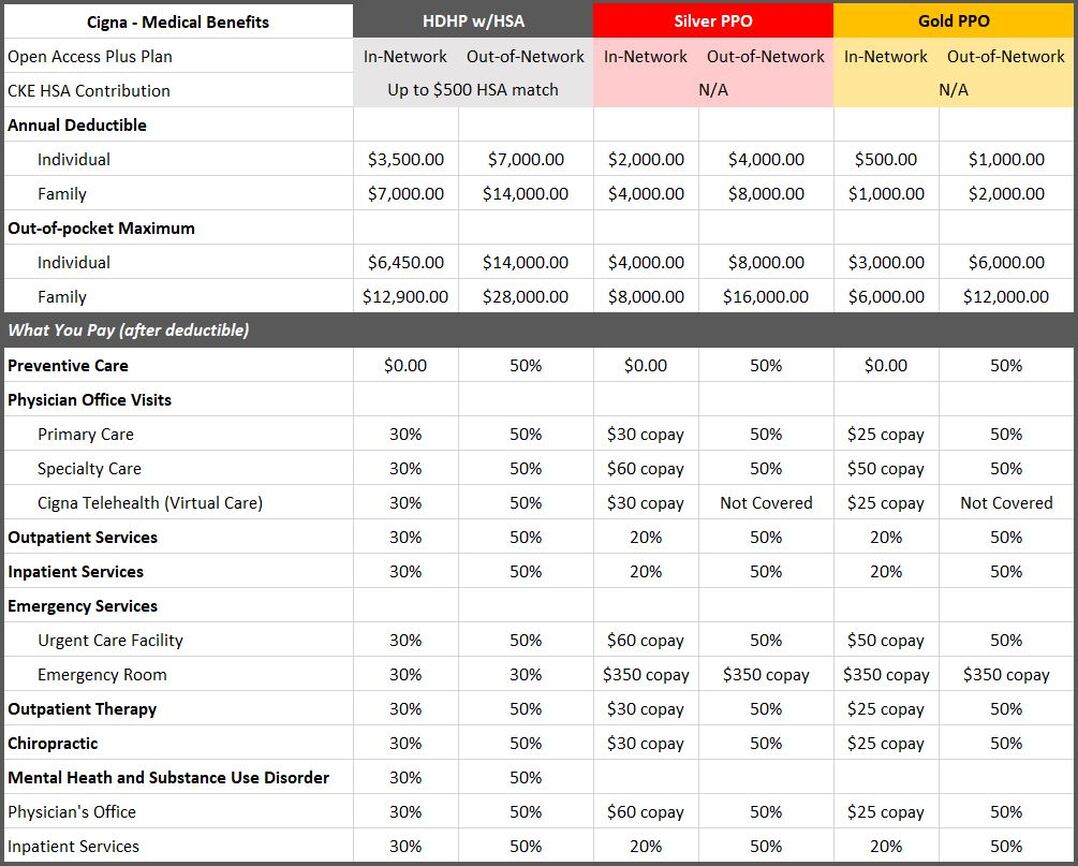

2024 Medical - Cigna (NEW!)

Medical Insurance - Cigna

CKE's medical and pharmacy coverage are provided through Cigna for 2024. Open Enrollment is always a great time to review your current benefits and decide on the best coverage for you and your family. Cigna offers a broad network of covered providers and a variety of plans to meet your coverage needs.

Upon enrollment, please allow 7-10 days for ID cards to arrive. Digital proof can be accessed via mycigna.com.

Upon enrollment, please allow 7-10 days for ID cards to arrive. Digital proof can be accessed via mycigna.com.

Cigna Provider Search

|

You can see any doctor you choose with no referrals, but you will always save money when utilizing in-network providers. Visit cigna.com to find doctors and facilities - you don’t have to log in to search! Just click “Find a Doctor, Dentist, or Facility”, select “Employer or School”, update your location, choose the kind of doctor you are looking for, and choose Open Access Plus, OA Plus, Choice Fund OA Plus.

|

This link leads to the machine readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine-readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.

Medical Plan Documents

|

HDHP w/HSA |

|

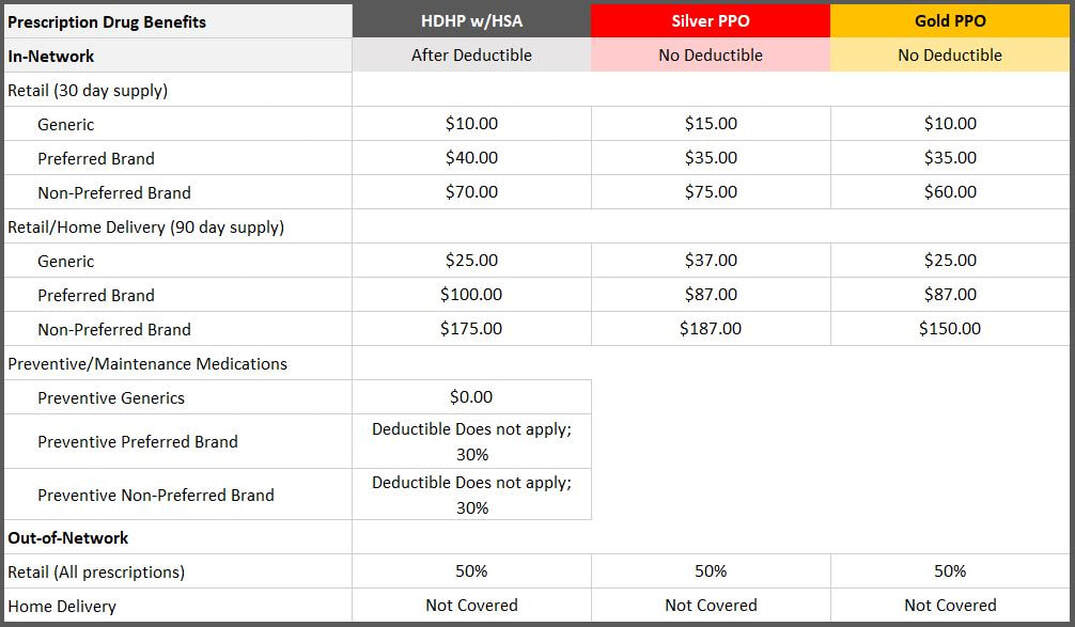

Prescription Drug Information

|

(Prescription Drug List; all plans)

|

This is a list of the most commonly prescribed medications covered on the Cigna Value 3-Tier Prescription Drug List as of July 1, 2021.1,2 Medications are listed by the condition they treat, then listed alphabetically within tiers (or cost-share levels).

This drug list is updated often so it isn’t a complete list of the medications your plan covers. Also, your specific plan may not cover all of these medications. Log in to the myCigna App and myCigna.com, or check your plan materials, to see all of the medications your plan covers. Prescription medications used to treat allergies (ex. Allegra, Clarinex, Xyzal and generics) and heartburn/stomach acid conditions (ex. Nexium, Prilosec and generics) aren’t covered on the Cigna Value 3-Tier Prescription Drug List. These medications are considered plan (or benefit) exclusions. You can get over-the-counter (OTC) versions of these medications at the pharmacy without a prescription. |

|

(HDHP medical plan only)

|

This is a list of Preventive Medications that may be covered under your plan. If your plan covers these Preventive Medications, your insurance benefit is applied before you meet your deductible.

Some medications may have other requirements or limits depending on your benefit plan and are noted below. To find out if a drug is covered, please check your plan benefits on the health plan’s member website. Or, call the toll-free phone number on your health plan ID card. This list may not be all-inclusive. Brand and generic drugs may not always be available due to market changes. |

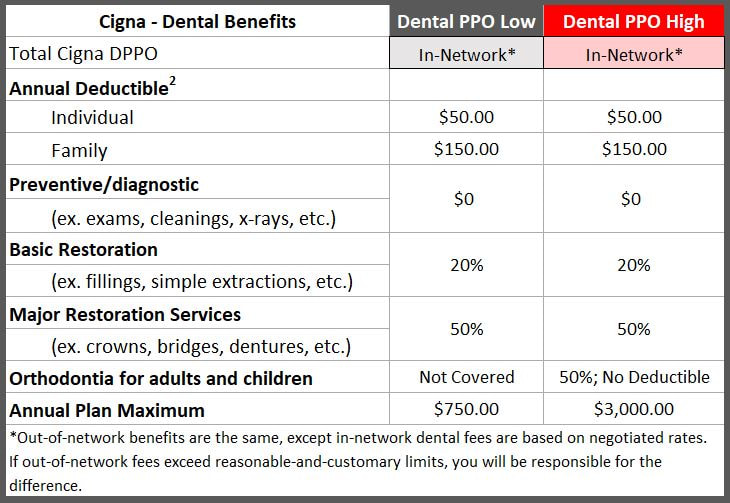

2024 Dental - Cigna (NEW!)

Dental Insurance - Cigna

Good dental health is a critical component of your overall wellness. Cigna administrates CKE's Dental options for 2023. We offer two different plans – Both have the same deductibles and coverage levels, covering preventive care and restorative services.

The High Plan provides Orthodontia benefits for both adults and dependent children, and has a higher annual maximum for you and every member of your family.

The High Plan provides Orthodontia benefits for both adults and dependent children, and has a higher annual maximum for you and every member of your family.

|

You can see any doctor you choose with no referrals, but you will always save money when utilizing in-network providers. Visit cigna.com to find doctors and facilities - you don’t have to log in to search! Just click “Find a Doctor, Dentist, or Facility”, select “Employer or School”, update your location, choose the kind of Dentist you are looking for, and choose Total Cigna DPPO (Cigna DPPO Advantage and Cigna DPPO)

|

2024 Vision - vsp (New!)

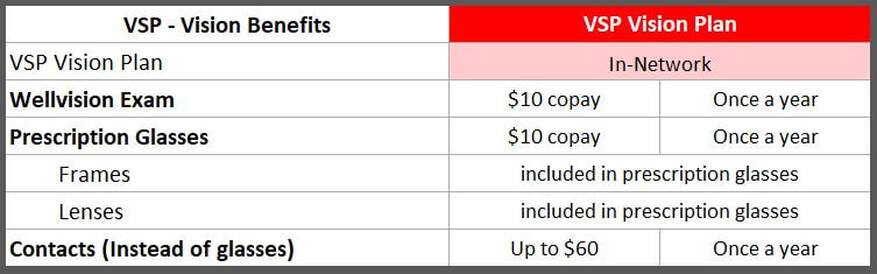

Vision Insurance - VSP

VSP administers our vision benefits, allowing you to get the best value, while being able to see the vision providers that you prefer!

You have the option to see any vision provider you choose, but benefits are highest when you use a network provider. Finding an in-network provider is simple. Just head over to VSP.com for a list of in-network vision care professionals - you don’t have to log in to search! Just click “Find a Doctor” and enter your location.

Please note, VSP does not issue ID cards. Your optometrist will verify coverage using your SSN.

You have the option to see any vision provider you choose, but benefits are highest when you use a network provider. Finding an in-network provider is simple. Just head over to VSP.com for a list of in-network vision care professionals - you don’t have to log in to search! Just click “Find a Doctor” and enter your location.

Please note, VSP does not issue ID cards. Your optometrist will verify coverage using your SSN.

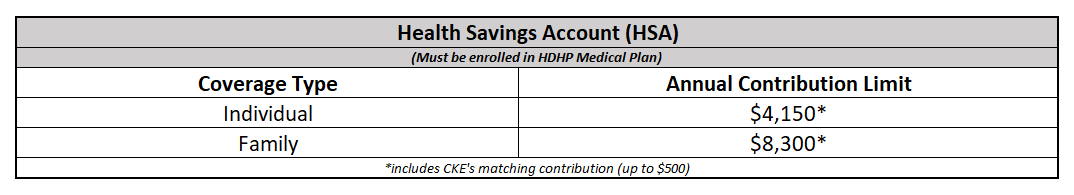

Health Savings Account (HSA)

Health Savings Account (HSA)

Cigna, in partnership with HSA Bank, administers CKE's Health Savings Account. This alignment will create expedited claim resolution and easy access to your HSA funds for medical claims.

When you enroll in the HDHP, you can contribute your own tax-free money to an HSA (via payroll deduction, up to annual IRS limits). *If you contribute at least $500 of your own money to your HSA, CKE will make a matching contribution of $500. Then, shortly after enrollment, you will receive an HSA debit card in the mail. It works like a bank debit card at any vendor that accepts healthcare cards.

Keep in mind, the IRS Contribution Limit includes CKE’s contributions – so if you contribute $500 and CKE contributes $500, the IRS views this as $1,000 toward the limit. Make your elections accordingly!

Cigna, in partnership with HSA Bank, administers CKE's Health Savings Account. This alignment will create expedited claim resolution and easy access to your HSA funds for medical claims.

When you enroll in the HDHP, you can contribute your own tax-free money to an HSA (via payroll deduction, up to annual IRS limits). *If you contribute at least $500 of your own money to your HSA, CKE will make a matching contribution of $500. Then, shortly after enrollment, you will receive an HSA debit card in the mail. It works like a bank debit card at any vendor that accepts healthcare cards.

Keep in mind, the IRS Contribution Limit includes CKE’s contributions – so if you contribute $500 and CKE contributes $500, the IRS views this as $1,000 toward the limit. Make your elections accordingly!

VOLUNTARY ACCIDENT AND CRITICAL ILLNESS

Voluntary Work/Life Benefits

Lincoln Financial gives you the choice of two additional benefit plans, Accident and Critical Illness. Your participation in these plans is totally voluntary. If you choose to enroll, you can pay your premiums via payroll deduction.

|

Accident Insurance: With accident insurance from Lincoln, you can help protect your budget against unforeseen expenses if you suffer an off-the-job injury. You can also cover your dependents! You can use the cash benefits from this coverage to help meet copays and other expenses, or any other way you see fit. The accident plan pays benefits for a variety of covered events – see the summary for more details.

|

|

Critical Illness: With critical illness insurance, you receive cash benefits when diagnosed with a covered critical illness. You can use this as you wish, to help cover medical or personal expenses. You can choose benefit amounts of $10,000, $15,000, or $20,000 for yourself and additional benefits for your dependents. The payable benefit varies by diagnosis – see the summary for more details.

|

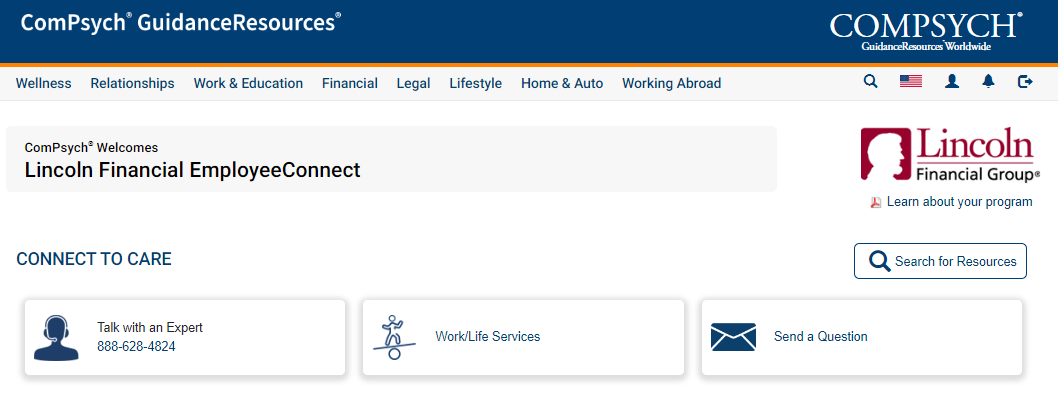

Employee Assistance program (EAP)

Employee Assistance Program (EAP)

|

Life comes with many demands — from family issues to legal and financial concerns to coping with stress. Occasionally these matters can affect your work, health and family. When that happens, count on EmployeeConnect PlusSM services to provide you with the support, resources and information you need to rise to the challenge.

|

2024 Enrollment Resources

2024 benefits eguide

2024 Benefits eGuide

Click the button below for your 2024 Benefits eGuide! This guide provides an in-depth look and all of the information you will need in order to make decisions about your 2024 Benefits.

Need help picking a plan?

Understanding Medical Plan Types

At CKE, we know that picking a health plan can be confusing and hard. That is why we have implemented some helpful tools to help you make the best decision for you and your family! Please check out the video below for a better understanding of what each plan type means and what you should be thinking about when completing your enrollment.

Cigna's Easy Choice Tool

Now that you know a little bit more about how medical plans work, Cigna is here to help you with the rest of your decision! CKE has partnered with Cigna to help you decide what medical plan is right for you. Using Cigna's Easy Choice Tool, you can answer some questions and the decision support tool will provide you with plan choices, which you can compare and review.

(To use the Decision Support Tool, you will need to use access code:YMJDQH96)

Still need more help? Contact Health Advocate...

Health Advocate

Do you need more assistance with making a decision for your 2024 Benefits? In partnership with CKE, Health Advocate is here to provide assistance to CKE employees and their family members. Health Advocate is a free service that makes healthcare easier, so you get the right coverage, the right care and the right support - at the right time!

|

With Health Advocate, experienced benefits specialists can:

|

Call: 866-695-8622

Visit: HealthAdvocate.com/members Email: [email protected] Download The App: at the App Store or Google Play |

MAKING CHANGES

Making Changes - Qualified Life Events

If you experience one of the events below, you will have 30 days from the date of your event or change in coverage.

To make the appropriate changes to your benefits, click on the button below for further instructions.

If you experience one of the events below, you will have 30 days from the date of your event or change in coverage.

- Marriage

- Birth/Adoption

- Death of a Covered Dependent

- Divorce

- Gain/Loss of Coverage for an Eligible Dependent (Spouse or Dependent Child)

To make the appropriate changes to your benefits, click on the button below for further instructions.

Please note that all life events will require formal documentation be submitted to [email protected].

- Marriage - a copy of the marriage certificate

- Divorce – a copy of the final divorce decree with the file date and judge’s signature.

- Birth – a copy of the birth certificate or the mother’s copy received in the hospital.

- Adoption – a copy of final adoption papers signed by a judge or a document stating the child has been placed in anticipation of adoption from the adoption agency.

- Death – a copy of the death certificate.

- Dependent’s Gain/Loss of Coverage Elsewhere – a copy of the hire/termination letter must be on company letterhead and state the hire/termination date and the date the employer-sponsored coverage either began or ended.

LEAVE OF ABSENCE (LOA)

|

All Leave of Absence and Family & Medical Leave (FMLA) services are administered by Lincoln Financial Group.

Lincoln Financial Group offers employees direct access to claims, resources and information. You can easily report a claim and check the status of your claim through Lincoln Financial Group's dedicated secure website of by telephone. Please visit: www.MyLincolnPortal.com to access employee resources and online tools. First time users must register using Company Code CKERHINC. Call 1-888-408-7300 and speak with an Intake Specialist to report your claim. Once you have already filed your claim, you can check the status of your claim by calling your Case Manager at 1-800-291-0112 or Leave Specialist at 1-866-630-9320. |

Enroll Now!

Enroll NOW!

Enrollment Instructions

|

To get started, log into your MyStar profile and select "Manage My Benefits".

*** Important *** Please be sure to complete the entire enrollment. Your benefits enrollment is now like an online shopping experience, where you add various coverages to your shopping cart and are displayed with a total cost per paycheck. Once you have made your elections, please be sure to check out and obtain a copy of your enrollment confirmation statement. If you do not complete the entire enrollment process and check out, your benefit enrollments will not be saved and you will NOT have coverage in 2024. |

Don't Forget...

If you do not enroll, you will NOT have benefits in 2024.

Generally, there are two times you can enroll for benefits: 1) when you first become eligible and 2) during Open Enrollment. Once you enroll, your choices remain in effect for the entire calendar year. Please make sure that you take the time to determine the correct benefits for you and your family for 2024.

Adding dependents?

If you are adding new dependents to your plan, please have their dates of birth and Social Security Number available.

Adding dependents?

If you are adding new dependents to your plan, please have their dates of birth and Social Security Number available.