Welcome to your 2021 Benefit Plans

At CKE, quality and service are key ingredients in our recipe for success. But it’s not just our fresh and innovative menu that makes us Impossible to Ignore — it’s also our people. That’s why CKE proudly offers up a benefits package created with you in mind.

If you are a recently hired or re-hired employee, benefits start on the first of the month following your hire/rehire date. Please take the time to understand your benefit enrollment options below. When you are ready to enroll, click the Enroll Now! section below and follow all instructions!

Frequently Asked Questions

When do my Benefits Start?

If you are a recently hired or re-hired employee, benefits start on the first of the month following your hire/rehire date.

If you were recently promoted into a General Manager position, your benefits start on the first of the month following your promotion.

When you enroll, these elections will be in place until the end of the Plan Year, December 31, 2021.

How do I enroll?

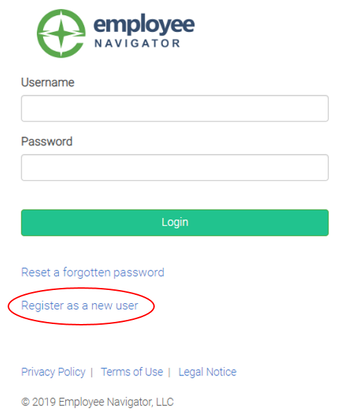

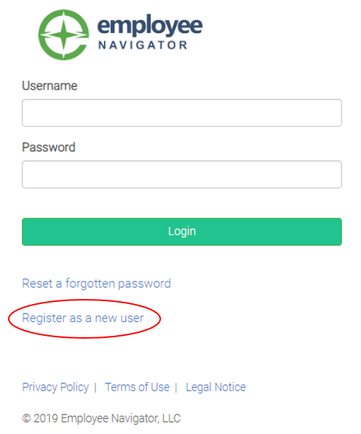

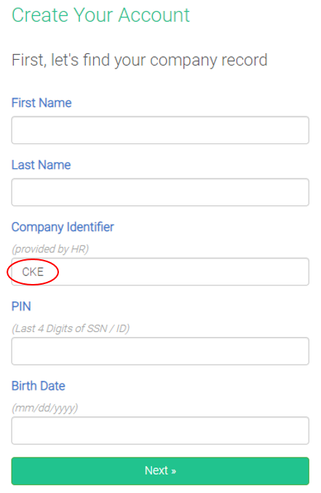

- If you have already registered your benefits account, visit the Employee Navigator Benefits Website and login with your username and password to complete your Open Enrollment.

- If you are a first-time-user, you will need to register your account and create a username/password. Please follow the instructions below.

*Please note that if you are new hire and just recently enrolled for 2020 coverage, you will need to also complete your Open Enrollment for 2021.

If you do not enroll during Open Enrollment, you will not have coverage in 2021.

|

Who should complete enrollment?

We encourage all CKE employees to take the time to complete their available enrollment opportunities.

Full-time benefits-eligible employees have the option to enroll in one or all of CKE's Medical, Dental, Vision, HSA/FSA, Life, Disability, and Voluntary Benefit Plans. Even if you do not intend to enroll in benefits, you should take this opportunity to make sure that your beneficiaries on file for your Life insurance are correct and up to date. This is a great opportunity to make sure that you are enrolled in the plans that best fit your and your family's needs.

Full-time benefits-eligible employees have the option to enroll in one or all of CKE's Medical, Dental, Vision, HSA/FSA, Life, Disability, and Voluntary Benefit Plans. Even if you do not intend to enroll in benefits, you should take this opportunity to make sure that your beneficiaries on file for your Life insurance are correct and up to date. This is a great opportunity to make sure that you are enrolled in the plans that best fit your and your family's needs.

What happens if i don't enroll?

If you do not enroll, you will not have coverage (except for any company-provided benefits).

Changes cannot be made throughout the year and your next opportunity to enroll will be during Open Enrollment for the 2022 Plan Year. The exception to this is if you experience a qualified Life Event (marriage, birth, adoption, etc.). For more details, visit the Making Changes section of the this website.

Changes cannot be made throughout the year and your next opportunity to enroll will be during Open Enrollment for the 2022 Plan Year. The exception to this is if you experience a qualified Life Event (marriage, birth, adoption, etc.). For more details, visit the Making Changes section of the this website.

Who are the benefit providers?

2021 Benefits

2021 Medical - UnitedHealthcare (UHC)

Medical Insurance - UnitedHealthcare (UHC)

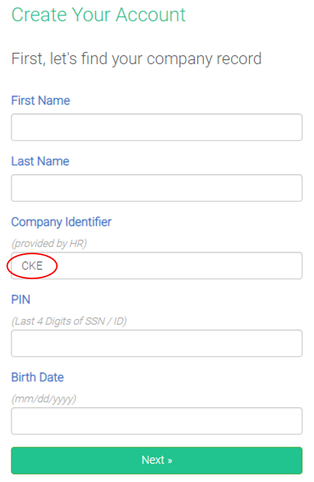

CKE's medical and pharmacy coverage will continue with UnitedHealthcare for 2021. Open Enrollment is always a great time to review your current benefits and decide on the best coverage for you and your family. UnitedHealthcare offers a broad network of covered providers and a variety of plans to meet your coverage needs.

UHC Provider Search

|

You can see any doctor you choose with no referrals, but you will always save money when utilizing in-network providers. Visit myuhc.com to find doctors and facilities - you don’t have to log in to search! Just click “Find a Doctor”, “All UnitedHealthcare Plans”, and choose Choice Plus

|

Medical Plan Documents

Prescription Drug Information

|

(all 3 medical plans)

|

This Prescription Drug List will provide you with a list of prescription medications covered by UHC; Cost for these medications depends on the plan you enroll in, according to chart above.

|

|

(all 3 medical plans)

|

The health reform law (Affordable Care Act) makes certain preventive medications and supplements available to you at no cost—both prescription and over-the-counter (OTC). The preventive medications on this list are covered at 100% with $0 copay when:

|

|

(HDHP medical plan only)

|

This is a list of Preventive Medications that may be covered under your plan. If your plan covers these Preventive Medications, your insurance benefit is applied before you meet your deductible.

Some medications may have other requirements or limits depending on your benefit plan and are noted below. To find out if a drug is covered, please check your plan benefits on the health plan’s member website. Or, call the toll-free phone number on your health plan ID card. This list may not be all-inclusive. Brand and generic drugs may not always be available due to market changes. |

2021 Dental - UnitedHealthcare (UHC)

Dental Insurance - UnitedHealthcare (UHC)

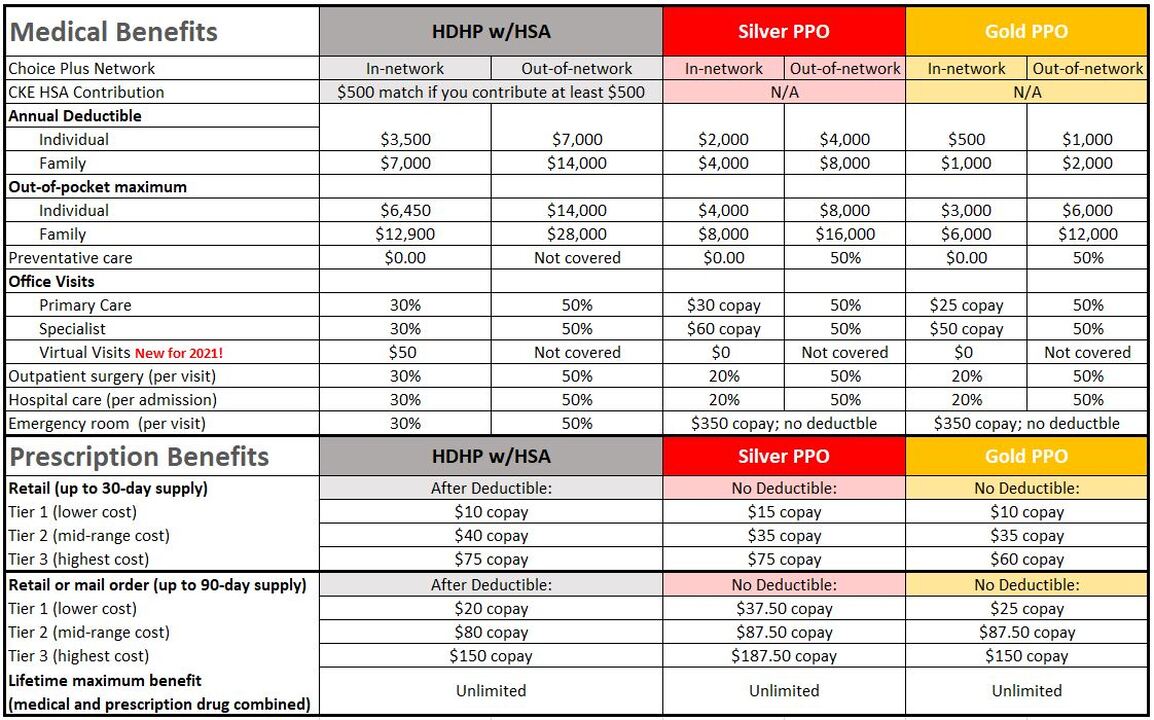

Good dental health is a critical component of your overall wellness. UnitedHealthcare will continue to provide our dental benefits for 2021. You have the choice between two plans – both have the same deductibles and coverage levels.

(New!) In 2021, the High Plan will now provide Orthodontia benefits for both adults and dependent children, and has a higher annual maximum for you and every member of your family.

(New!) In 2021, the High Plan will now provide Orthodontia benefits for both adults and dependent children, and has a higher annual maximum for you and every member of your family.

UHC Dentist Search

|

With either option, you can see any dentist you choose, but benefits are highest when you use a network provider. Visit myuhc.com to find dentists - you don’t have to log in to search! Just click “Find a Dentist”, enter your location, and choose "National Options PPO 30".

|

Dental Plan Documents

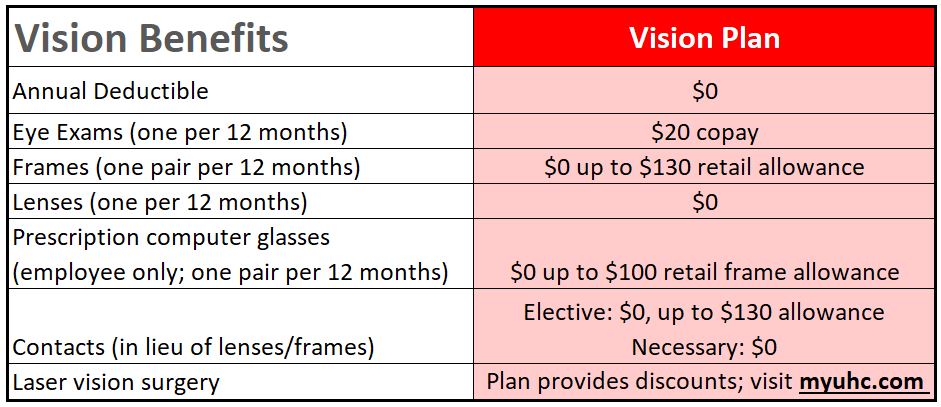

2021 Vision - Unitedhealthcare (UHC)

Vision Insurance - UnitedHealthcare (UHC)

If you wear glasses or contacts, you know vision expenses can add up. UnitedHealthcare will continue to provide our vision benefits for 2021. We have consolidated the vision plans to make this choice easier for you! Your plan remains the same, except now the Vision plan includes an additional benefit for computer glasses. The computer glasses benefit gives you an additional $100 frame allowance to purchase a 2nd pair of prescription glasses that include protection against blue light. There is no additional material copay for the 2nd pair of computer glasses. You can choose any frame at network provider locations and apply the frame allowance toward the cost. This benefit is only for you and does not include dependents.

You still have the option to see any vision provider you choose, but benefits are highest when you use a network provider. Visit myuhc.com to find vision care professionals - you don’t have to log in to search! Just click “Find a Vision Provider” and enter your location.

You still have the option to see any vision provider you choose, but benefits are highest when you use a network provider. Visit myuhc.com to find vision care professionals - you don’t have to log in to search! Just click “Find a Vision Provider” and enter your location.

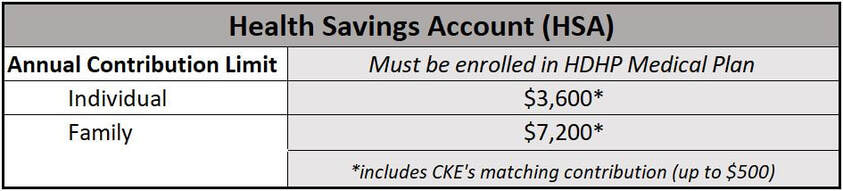

Health Savings Account (HSA)

Health Savings Account (HSA)

When you enroll in the HDHP, you can contribute your own tax-free money to an HSA (via payroll deduction, up to annual IRS limits). *If you contribute at least $500 of your own money to your HSA, CKE will make a matching contribution of $500. Then, shortly after enrollment, you will receive an HSA debit card in the mail. It works like a bank debit card at any vendor that accepts healthcare cards.

Keep in mind, the IRS Contribution Limit includes CKE’s contributions – so if you contribute $500 and CKE contributes $500, the IRS views this as $1,000 toward the limit. Make your elections accordingly!

When you enroll in the HDHP, you can contribute your own tax-free money to an HSA (via payroll deduction, up to annual IRS limits). *If you contribute at least $500 of your own money to your HSA, CKE will make a matching contribution of $500. Then, shortly after enrollment, you will receive an HSA debit card in the mail. It works like a bank debit card at any vendor that accepts healthcare cards.

Keep in mind, the IRS Contribution Limit includes CKE’s contributions – so if you contribute $500 and CKE contributes $500, the IRS views this as $1,000 toward the limit. Make your elections accordingly!

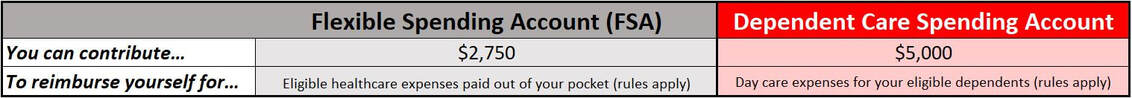

Flexible Spending Accounts (FSA)

Flexible Spending Accounts (FSA)

CKE offers two flexible spending accounts (FSAs) – a Healthcare FSA and a Dependent care FSA – administered by PayFlex.

With FSAs, you set aside tax-free money from your paycheck to pay for out-of-pocket expenses like deductibles, copays, coinsurance, childcare and adult daycare. You pay less for these expenses because the money is not taxed when it is deducted from your paycheck or when you use it to pay for eligible expenses. Refer to the PayFlex.com website for a list of eligible expenses.

With FSAs, you set aside tax-free money from your paycheck to pay for out-of-pocket expenses like deductibles, copays, coinsurance, childcare and adult daycare. You pay less for these expenses because the money is not taxed when it is deducted from your paycheck or when you use it to pay for eligible expenses. Refer to the PayFlex.com website for a list of eligible expenses.

- You can contribute to one or both of the FSAs.

- You do not have to be enrolled in other coverage to participate.

- You cannot contribute to the Healthcare FSA if you are enrolled in a Health Savings Account (HSA).

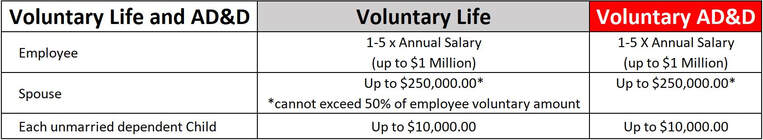

Life and disability

Life and Disability Insurance

Life and AD&D Insurance provides financial protection in the event you or a covered family member dies or becomes seriously injured in an accident. Coverage is provided through Lincoln Financial.

|

Basic Life and AD&D: CKE automatically provides regular full-time employees with basic life insurance of 1x your annual salary (up to $500,000) and an equal amount of AD&D coverage, at no cost to you.

|

|

Voluntary Life: You can purchase voluntary coverage to supplement your basic coverage. If you elect voluntary life for yourself, you can also elect it for your family, as follows: |

|

Evidence of Insurability (EOI): Evidence of Insurability is an application process through which you provide information on the condition of your or your dependent's health in order to be considered for certain types of insurance coverage over a specific dollar amount. For CKE, EOI is required for most changes or increases in voluntary life insurance and/or long-term disability insurance elections.

|

|

Short-term Disability: If you are a regular full-time employee, short-term disability is provided by CKE at no cost to you. Short-term Disability Insurance provides you with 60% of your weekly income up to $1,500 if you can’t work temporarily due to a covered illness, injury or a pregnancy-related condition. Benefits for employees in CA will coordinate with CA SDI benefits. Not available in NY, NJ, HI, RI.

|

|

Long-term Disability: Long-term disability coverage generally picks up where short-term disability coverage leaves off to protect you financially if your disability continues for an extended period. If you are unable to work for an extended period of time due to a covered disability, this benefit will replace 40% of your monthly income up to $10,000 beginning at 6 months off of work. You may purchase an additional 20% as a voluntary add-on to make your benefit a total of 60%. |

Voluntary Accident and critical Illness

Voluntary Work/Life Benefits

Lincoln Financial gives you the choice of two additional benefit plans, Accident and Critical Illness. Your participation in these plans is totally voluntary. If you choose to enroll, you can pay your premiums via payroll deduction.

|

Accident Insurance: With accident insurance from Lincoln, you can help protect your budget against unforeseen expenses if you suffer an off-the-job injury. You can also cover your dependents! You can use the cash benefits from this coverage to help meet copays and other expenses, or any other way you see fit. The accident plan pays benefits for a variety of covered events – see the summary for more details.

|

|

Critical Illness: With critical illness insurance, you receive cash benefits when diagnosed with a covered critical illness. You can use this as you wish, to help cover medical or personal expenses. You can choose benefit amounts of $10,000, $15,000, or $20,000 for yourself and additional benefits for your dependents. The payable benefit varies by diagnosis – see the summary for more details.

|

employee assistance program (EAP)

Employee Assistance Program (EAP)

Life comes with many demands — from family issues to legal and financial concerns to coping with stress. Occasionally these matters can affect your work, health and family. When that happens, count on EmployeeConnect services to provide you with the support, resources and information you need to rise to the challenge.

Retirement (401k)

CKE Savings Plan

***IMPORTANT UPDATE***

As you may recall, The CKE Savings Plan was scheduled to transition from Wells Fargo to Principal Financial Group. This transition is due to Principal Financial Group’s 2019 acquisition of the Wells Fargo Institutional Retirement & Trust business. We are happy to announce that the move of our retirement plan services from to Principal is complete! Principal has been a leader in providing retirement solutions for over 75 years. We’re excited to share the new features, tools, and resources you can use to help save for, and live in, retirement. Provided below is more information about the transition and an option webinar.

Welcome to Principal!

Start exploring

All eligible participants can now register on the Principal website (principal.com/welcome) and select Get Started. Watch for an email or letter from Principal providing directions on how to log in and review your retirement account. From there, you can take a closer look at some of the robust features available to you, including:

- Customized dashboard for your retirement account

- Retirement Wellness Score – personalized score to see how you’re tracking towards your retirement goals

- Principal® Milestones – a financial wellness resource that provides self-serve, personalized, online education

- Principal® app – streamlined for convenience, it puts you in control with retirement wellness checks, in-the-moment education and self-serve transaction capabilities

- Principal® Flash Briefing – voice assistant delivering tips, fun facts, and reminders weekly

Join upcoming webinar

Principal will also share more information on the new services and resources in an upcoming webinar on July 7th at 11:00am CST. Register here.

If you can’t make it, you can always watch the replay if you register.

Maintain your current lifestyle in retirement. For each year of retirement, many experts suggest you’ll need at least 80% of your annual preretirement income to maintain your standard of living. And thanks to medical advancements, many people are living longer, which could mean a longer retirement and a need to save a larger amount of money.

Reduce your current tax bill and possibly boost your refund. Every pretax dollar you contribute to the plan reduces your current taxable income, which means you could lower your overall income taxes. You may also be eligible for the Saver’s Credit, an income tax credit available to some people who contribute to an employer’s retirement plan or IRA.1

Pick from a variety of investment options. The plan offers a wide variety of investment options so you can personalize your investment portfolio to meet your specific preferences and goals.

Employer Matching Contributions. CKE will contribute $0.25 for every $1.00 that you contribute, up to 6% of your pay. Try to save at least 6% to ensure you aren’t missing out on receiving the maximum matching contribution.

Highly Compensated Employees. Highly Compensated Employees (HCEs) are limited to saving 5% of total eligible compensation. CKE identifies an HCE as an employee receiving $130,000.00 or more in eligible compensation during the current Plan year. If you have questions about your classification as an HCE, please contact the CKE Benefits team.

Paid PArental Leave (NEW!)

Effective April 1, 2021, CKE Restaurants Holdings, Inc., Carl’s Jr. Restaurants LLC and Hardee’s Restaurants LLC (collectively, “the Company”) has adopted a Paid Parental Leave Policy (“Policy”) for all Eligible Employees. In general, the Policy provides Eligible Employees up to 4 weeks (160 hours) of paid parental leave for time away from work to fulfill a short-term disability waiting period or to bond with a child, as a result of birth (including surrogacy) and/or adoption.

Who is Eligible?

Who is Eligible?

- Regular full-time employees (General Manager and Corporate Level) who have incurred a Qualifying Family Event while actively employed by CKE Restaurants Holdings, Inc. on or after April 1, 2021

- Both birth and non-birth parents

- For exclusions and more policy details, please refer to the CKE Paid Parental Leave website.

2021 Enrollment Resources

2021 Enrollment Tools

|

|

|

Click the button below for an overview of what is changing in 2021 and other important information that you will need to know.

|

Click the button below for your 2021 Benefits eGuide! This guide provides an in-depth look at your 2021 Benefits and has all of the information you will need in order to make decisions about your 2021 Benefits.

|

Health Advocate

Do you need more assistance with making a decision for your 2021 Benefits? In partnership with CKE, Health Advocate is here to provide assistance to CKE employees and their family members. Health Advocate is a free service that makes healthcare easier, so you get the right coverage, the right care and the right support - at the right time!

|

With Health Advocate, experienced benefits specialists can:

|

Call: 866-695-8622

Visit: HealthAdvocate.com/members Email: [email protected] Download The App: at the App Store or Google Play |

leave of absence (loa)

|

Effective June 1, 2020, all Leave of Absence, Short-term Disability, Long-term Disability , and Family & Medical Leave (FMLA) services will be administered by Lincoln Financial Group.

Lincoln Financial Group offers employees direct access to claims, resources, and information. You can easily report a claim and check the status of your claim through Lincoln Financial Group's dedicated secure website of by telephone. Please visit: www.MyLincolnPortal.com to access employee resources and online tools. First time users must register using Company Code CKERHINC. Call 1-888-408-7300 and speak with an Intake Specialist to report your claim. Once you have already filed your claim, you can check the status of your claim by calling your Case Manager at 1-800-291-0112 or Leave Specialist at 1-866-630-9320 |

making changes

Making Changes - Qualified Life Events

If you experience one of the events below, you will have 30 days from the date of your event or change in coverage.

To make the appropriate changes to your benefits, follow the instructions below:

*for other events (Dependent's Gain/Loss of coverage), the date of the event is the first day your dependent no longer has their previous coverage

- Marriage

- Birth/Adoption

- Death of a Covered Dependent

- Divorce

- Gain/Loss of Coverage for an Eligible Dependent (Spouse or Dependent Child)

To make the appropriate changes to your benefits, follow the instructions below:

- Visit Employee Navigator Benefits Website

- Log in with your username and your password (If you are a new user, click on the Enroll Now section above to create your account)

- Click the "Adjust Coverage" icon, select the appropriate life event, and enter the appropriate event date*

*for other events (Dependent's Gain/Loss of coverage), the date of the event is the first day your dependent no longer has their previous coverage

|

Please note that all life events will require formal documentation be submitted to the benefits department.

|

|

COBRA

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss, reduction in the hours worked, transition between jobs, death, divorce, and other life events. Qualified individuals may be required to pay the entire premium for coverage up to 102 percent of the cost to the plan.

COBRA generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage (called continuation coverage) in certain instances where coverage under the plan would otherwise end.

COBRA generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage (called continuation coverage) in certain instances where coverage under the plan would otherwise end.

Enroll Now!

Enroll NOW!

Enrollment Instructions

If you are a recently hired or re-hired employee, benefits start on the first of the month following your hire/rehire date. Please take the time to understand the benefit enrollment options available to you. When you are ready to enroll, follow the instructions below!

If you do not enroll during Open Enrollment, you will not have coverage in 2021.

- If you have already registered your benefits account, visit the Employee Navigator Benefits Website and login with your username and password to complete your Open Enrollment.

- If you are a first-time-user, you will need to register your account and create a username/password. Please follow the instructions below.

If you do not enroll during Open Enrollment, you will not have coverage in 2021.

|

Don't Forget...

If you do not enroll, you will not have benefits in 2021.

Generally, there are two times you can enroll for benefits: 1) when you first become eligible and 2) during Open Enrollment. Once you enroll, your choices remain in effect for the entire calendar year. Please make sure that you take the time to determine the correct benefits for you and your family for 2020.

Adding dependents?

If you are adding new dependents to your plan, please have their dates of birth and Social Security Number available.

Adding dependents?

If you are adding new dependents to your plan, please have their dates of birth and Social Security Number available.