Welcome to your 2019 Benefits!

At CKE, quality and service are key ingredients in our recipe for success. But it’s not just our fresh and innovative menu that makes us Impossible to Ignore — it’s also our people. That’s why CKE proudly offers up a benefits package created with you in mind.

At CKE, quality and service are key ingredients in our recipe for success. But it’s not just our fresh and innovative menu that makes us Impossible to Ignore — it’s also our people. That’s why CKE proudly offers up a benefits package created with you in mind.

Medical/Prescription

Medical - Reliance

Reliance Standard Medical Plan

Pays you cash benefits for covered services:

Hospital Room & Board

$100/day (90 max)

Hospital Admission Benefit (Accidental Injury)

$1,000/day (1 max)

Maximum Surgery Benefit/Procedure

$500/day

Preventive Wellness Screening

FREE!

Dental

Dental

Good dental health is a critical component of your overall health. Your dental plan is through Guardian and provides benefits for preventive, basic and major services. To find a Guardian network dentist in your area, go to Guardian Dental.

Guardian Dental PPO

$50 (I)

Deductible

$1,000

Annual Maximum

$500

Annual Maximum Rollover Year-to-Year

$50 (I)

Deductible

$1,000

Annual Maximum

$500

Annual Maximum Rollover Year-to-Year

Vision

Vision

If you wear glasses or contacts, you know vision expenses can add up. At CKE, vision benefits are provided by EyeMed. Even if you don’t wear contacts or glasses, annual eye exams are recommended. All Vision plans come with one of the largest vision networks in the country. To find a Vision provider, visit EyeMed Vision.

EyeMed Vision Plan

$10 copay

Eye Exams

$25

Lenses

Allowance

Frames

$10 copay

Eye Exams

$25

Lenses

Allowance

Frames

Work/Life Benefits

Work Life Benefits

Accident

Off-the-Job Protection. The High Plan includes $1,500 for Hospital Confinement, $75 for Outpatient Physician, and up to $300 for Emergency Room coverage.

Off-the-Job Protection. The High Plan includes $1,500 for Hospital Confinement, $75 for Outpatient Physician, and up to $300 for Emergency Room coverage.

Universal Life

Protect your family. A $40,000, $60,000 or $80,000 benefit helps provide financial protection in the event of your death. Spouse and Children coverage is offered as well!

Protect your family. A $40,000, $60,000 or $80,000 benefit helps provide financial protection in the event of your death. Spouse and Children coverage is offered as well!

Individual Short-Term Disability

Provides you with a monthly cash benefit if you are faced with an unexpected sickness or off-the-job injury to help pay for treatment for up to 3 months.

Provides you with a monthly cash benefit if you are faced with an unexpected sickness or off-the-job injury to help pay for treatment for up to 3 months.

Auto/Legal/Home/Pet

Save money on the lifestyle benefits you need, with group discounts and convenient payroll deductions.

Save money on the lifestyle benefits you need, with group discounts and convenient payroll deductions.

Enroll Now

Enrollment Instructions

If you were recently hired or re-hired, you should receive a registration link to the email address on file.

If you were not hired recently or still have to create/register your Benefits account, follow the enrollment instructions provided below.

- If you have a CKE email address, the registration link will be sent to that email address.

- If you do not have a CKE email address, the registration link will be sent to your personal email address on file.

- Follow the instructions in the email to create/register your Benefits account.

If you were not hired recently or still have to create/register your Benefits account, follow the enrollment instructions provided below.

|

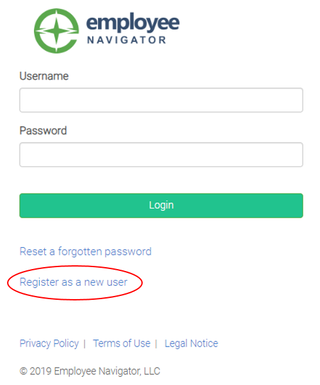

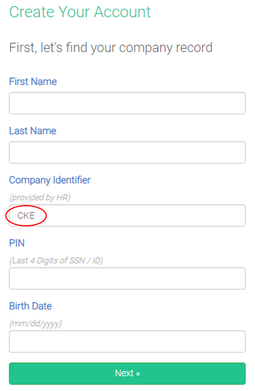

Step 1: Visit Employee Navigator Benefits Website Step 2: Click on "Register as a new user". Step 3: Enter your own Personal Information (Company Identifier will be "CKE") and click Next. Step 4: You will be prompted to create a username and password.

|

Don't Forget...

You must enroll in or decline benefits within 30 days of your hire date as a benefits-eligible employee. If you miss this deadline, you won’t have the opportunity to enroll again until Annual Open Enrollment. The only exception to this rule is if you have a “qualified life event” such as marriage, divorce, the birth of a child, or the loss of coverage under your spouse’s medical plan.

Adding dependents?

If you are adding new dependents to your plan, please have their dates of birth and Social Security Number available.

Did you call the concierge?

Did you call the Aetna Concierge to ensure you are selecting the best medical plan for your family?

Aetna Concierge

The Aetna Concierge has the answers to your questions about your benefits or healthcare services. They can help you decide what health plan to select by explaining plan details, finding a provider in your area, and more! They are available for you at 855-217-2836

Adding dependents?

If you are adding new dependents to your plan, please have their dates of birth and Social Security Number available.

Did you call the concierge?

Did you call the Aetna Concierge to ensure you are selecting the best medical plan for your family?

Aetna Concierge

The Aetna Concierge has the answers to your questions about your benefits or healthcare services. They can help you decide what health plan to select by explaining plan details, finding a provider in your area, and more! They are available for you at 855-217-2836

Making Changes

Making Changes - Qualified Life Events

If you experience one of the events below, you will have 30 days from the date of your event or change in coverage.

To make the appropriate changes to your benefits, follow the instructions below:

*for other events (Dependent's Gain/Loss of coverage), the date of the event is the first day your dependent no longer has their previous coverage

Please note that all life events will require formal documentation be submitted to the benefits department.

If you experience one of the events below, you will have 30 days from the date of your event or change in coverage.

- Marriage

- Birth/Adoption

- Death of a Covered Dependent

- Divorce

- Gain/Loss of Coverage for an Eligible Dependent (Spouse or Dependent Child)

To make the appropriate changes to your benefits, follow the instructions below:

- Visit Employee Navigator Benefits Website

- Log in with your username and your password (If you are a new user, click on the Enroll Now section above to create your account)

- Click the "Adjust Coverage" icon, select the appropriate life event, and enter the appropriate event date*

*for other events (Dependent's Gain/Loss of coverage), the date of the event is the first day your dependent no longer has their previous coverage

Please note that all life events will require formal documentation be submitted to the benefits department.

- Marriage - a copy of the marriage certificate

- Divorce – a copy of the final divorce decree with the file date and judge’s signature.

- Birth – a copy of the birth certificate or the mother’s copy received in the hospital.

- Adoption – a copy of final adoption papers signed by a judge or a document stating the child has been placed in anticipation of adoption from the adoption agency.

- Death – a copy of the death certificate.

- Dependent’s Gain/Los of Coverage Elsewhere – a copy of the hire/termination letter must be on company letterhead and state the hire/termination date and the date the employer-sponsored coverage either began or ended.

COBRA

The Consolidated Omnibus Budget Reconciliation Act (COBRA) gives workers and their families who lose their health benefits the right to choose to continue group health benefits provided by their group health plan for limited periods of time under certain circumstances such as voluntary or involuntary job loss, reduction in the hours worked, transition between jobs, death, divorce, and other life events. Qualified individuals may be required to pay the entire premium for coverage up to 102 percent of the cost to the plan.

COBRA generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage (called continuation coverage) in certain instances where coverage under the plan would otherwise end.

COBRA generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity for a temporary extension of health coverage (called continuation coverage) in certain instances where coverage under the plan would otherwise end.