2020 Plan Information

2020 MEDICAL - (NEW!)

Medical Insurance - United Healthcare (UHC)

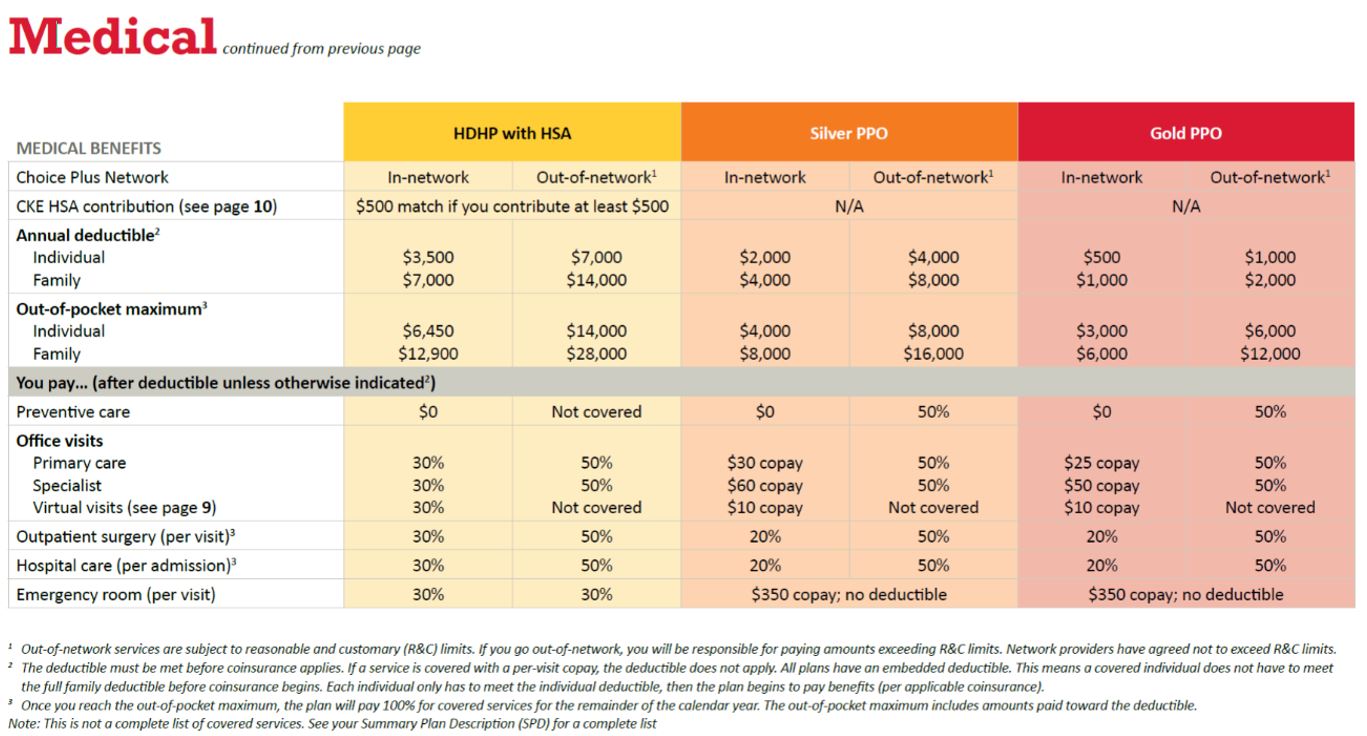

For 2020, United HealthCare (UHC) is replacing Aetna as the administrator of our medical and pharmacy plans. If you’ve always chosen the plan with the lowest deductible or haven’t found a CKE plan to be the best for you in the past, give it a closer look for 2020! Your options and your premiums have changed – for example, all plans now have a broader network and out-of-network benefits.

Prescription Drug Coverage

Transition of Care

If you had a previously authorized procedure(s) in 2019 with Aetna or if you have a procedure scheduled for 2020, you will want to be sure that United Healthcare also authorizes it. With your doctor's help, you can complete the Transition of Care form to request authorization from UHC.

Provider Search

You can see any doctor you choose with no referrals, but you will always save money when utilizing in-network providers. Visit myuhc.com to find doctors and facilities - you don’t have to log in to search! Just click “Find a Doctor”, “All UnitedHealthcare Plans”, and choose Choice Plus

2020 Dental - (NEW!)

Dental - UHC

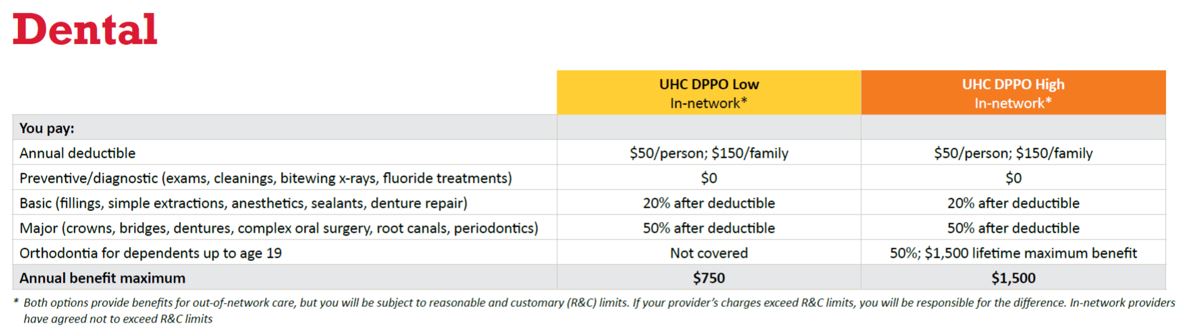

Good dental health is a critical component of your overall wellness. UnitedHealthcare will provide our dental benefits for 2020. You have the choice between two plans – both have the same deductibles and coverage levels, but the High Plan provides Orthodontia benefits for your children up to age 19, and has a higher annual maximum for you and every member of your family.

With either option, you can see any dentist you choose, but benefits are highest when you use a network provider. Visit myuhc.com to find dentists - you don’t have to log in to search! Just click “Find a Dentist”, enter your location, and choose "National Options PPO 30".

With either option, you can see any dentist you choose, but benefits are highest when you use a network provider. Visit myuhc.com to find dentists - you don’t have to log in to search! Just click “Find a Dentist”, enter your location, and choose "National Options PPO 30".

2020 Vision - (NEW!)

Vision - UHC

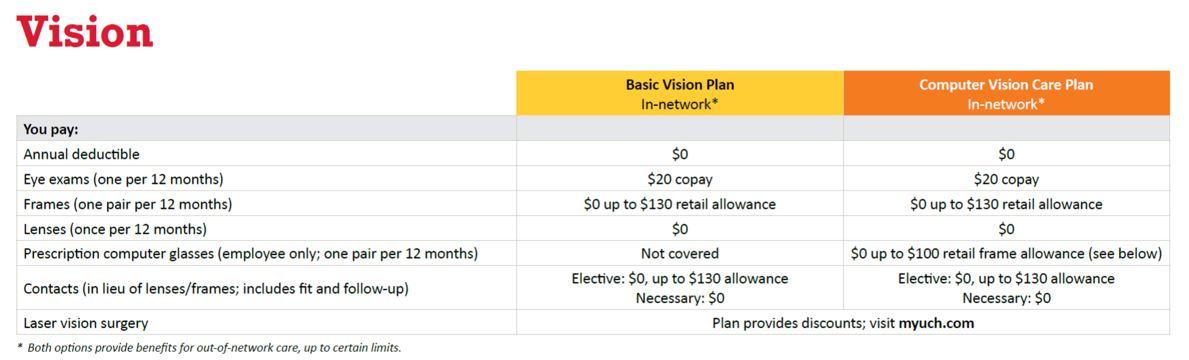

If you wear glasses or contacts, you know vision expenses can add up. UnitedHealthcare will provide our vision benefits for 2020. You’ll still have the choice of two options, both of which cover the same services at the same benefit level, but the Computer Vision Care Plan includes an additional benefit for computer glasses. The computer glasses benefit gives you an additional $100 frame allowance to purchase a 2nd pair of prescription glasses that include protection against blue light. There is no additional material copay for the 2nd pair of computer glasses. You can choose any frame at network provider locations and apply the frame allowance toward the cost. This benefit is only for you and does not include dependents.

With either option, you can see any vision provider you choose, but benefits are highest when you use a network provider. Visit myuhc.com to find vision care professionals - you don’t have to log in to search! Just click “Find a Vision Provider” and enter your location.

With either option, you can see any vision provider you choose, but benefits are highest when you use a network provider. Visit myuhc.com to find vision care professionals - you don’t have to log in to search! Just click “Find a Vision Provider” and enter your location.

There is only 1 summary plan document because the coverages are the same, except the additional allowances under the Computer Vision Care plan, as referenced above.

2020 Health Savings Account (HSA)

Health Savings Account (HSA)

|

Reasons to Elect an HSA

Your funds rollover from year-to-year. Contribute tax-free deposits from your paychecks into your account automatically! Lastly, you can pay for health care expenses, save for retirement, and more! |

Pay for Health Care Expenses

Use your HSA as an option to pay for your health care expenses tax-free. A debit card is provided to you, making paying for your services easier than ever before. |

CKE HSA Matching Contributions

Just like in 2019, CKE will continue to match up to $500 of your annual HSA contributions. CKE’s contributions will be prorated, so you will receive an equal portion of the match on each of your 2020 paychecks.

Keep in mind, the IRS Contribution Limit includes CKE’s contributions – so if you contribute $500 and CKE contributes $500, the IRS views this as $1,000 toward the limit. Make your elections accordingly!

Just like in 2019, CKE will continue to match up to $500 of your annual HSA contributions. CKE’s contributions will be prorated, so you will receive an equal portion of the match on each of your 2020 paychecks.

Keep in mind, the IRS Contribution Limit includes CKE’s contributions – so if you contribute $500 and CKE contributes $500, the IRS views this as $1,000 toward the limit. Make your elections accordingly!

Annual IRS Contribution Limits

|

Individual Contribution

2020 HSA Annual Contribution Limit $3,550.00 |

Family Contribution

2020 HSA Annual Contribution Limit $7,100.00 |

2020 Flexible Spending Accounts (FSA)

Flexible Spending Account (FSA)

Want to reduce your taxable income and increase your take-home pay? Enroll in an FSA and start saving money on eligible health care and/or dependent care expenses.

|

Health Care FSA

Contribute pre-tax dollars from your paycheck to pay for eligible health care expenses for you and your dependents. $2,700.00 Annual Contribution Limit |

Dependent Care Spending

A Dependent Care enables you to set aside pre-tax dollars to pay for qualified dependent care expenses. Funds can be used to pay for day care, preschool, elderly care or other dependent care. $5,000 Annual Contribution Limit |

2020 Life And Disability - (NEW!)

Life and Disability

Basic Life and AD&D

|

Voluntary Supplemental Life Insurance

|

Retirement (401k)

CKE Savings Plan

Take the steps toward a better future today.

Maintain your current lifestyle in retirement.

For each year of retirement, many experts suggest you’ll need at least 80% of your annual preretirement income to maintain your standard of living. And thanks to medical advancements, many people are living longer, which could mean a longer retirement and a need to save a larger amount of money.

Reduce your current tax bill and possibly boost your refund.

Every pretax dollar you contribute to the plan reduces your current taxable income, which means you could lower your overall income taxes. You may also be eligible for the Saver’s Credit, an income tax credit available to some people who contribute to an employer’s retirement plan or IRA.1

Pick from a variety of investment options.

The plan offers a wide variety of investment options so you can personalize your investment portfolio to meet your specific preferences and goals.

Save easily with payroll deductions.

Make it easy to pay yourself first.

Employer Matching Contributions

CKE will contribute $0.25 for every $1.00 that you contribute, up to 6% of your pay.

Try to save at least 6% to ensure you aren’t missing out on receiving the maximum matching contribution.

Take the steps toward a better future today.

Maintain your current lifestyle in retirement.

For each year of retirement, many experts suggest you’ll need at least 80% of your annual preretirement income to maintain your standard of living. And thanks to medical advancements, many people are living longer, which could mean a longer retirement and a need to save a larger amount of money.

Reduce your current tax bill and possibly boost your refund.

Every pretax dollar you contribute to the plan reduces your current taxable income, which means you could lower your overall income taxes. You may also be eligible for the Saver’s Credit, an income tax credit available to some people who contribute to an employer’s retirement plan or IRA.1

Pick from a variety of investment options.

The plan offers a wide variety of investment options so you can personalize your investment portfolio to meet your specific preferences and goals.

Save easily with payroll deductions.

Make it easy to pay yourself first.

Employer Matching Contributions

CKE will contribute $0.25 for every $1.00 that you contribute, up to 6% of your pay.

Try to save at least 6% to ensure you aren’t missing out on receiving the maximum matching contribution.

Voluntary Benefits

Work Life Benefits

Lincoln Financial gives you the choice of two additional benefit plans, Accident and Critical Illness. Your participation in these plans is totally voluntary – if you choose to enroll, you can pay your premiums via payroll deduction.

|

Critical Illness

Critical Illness: With critical illness insurance, you receive cash benefits when diagnosed with a covered critical illness. You can use this as you wish, to help cover medical or personal expenses. You can choose benefit amounts of $10,000, $15,000, or $20,000 for yourself and additional benefits for your dependents. The payable benefit varies by diagnosis – see the summary for more details. |

Accident

With accident insurance from Lincoln, you can help protect your budget against unforeseen expenses if you suffer an off-the-job injury. You can also cover your dependents! You can use the cash benefits from this coverage to help meet copays and other expenses, or any other way you see fit. The accident plan pays benefits for a variety of covered events – see the summary for more details. |

Open Enrollment Resources

2020 Open Enrollment TOOLS

|

|

Health Advocate

Do you need more assistance with making a decision for your 2020 Benefits? New this year, CKE is partnering with Health Advocate to provide assistance to CKE employees and their family members. Health Advocate is a free service that makes healthcare easier, so you get the right coverage, the right care and the right support - at the right time

|

With Health Advocate, experienced benefits specialists can:

|

Call: 866-695-8622

Visit: HealthAdvocate.com/members Email: [email protected] Download The App: at the App Store or Google Play |